Car Import Austria

NOVA, Customs & Taxes

Have you found your dream car cheaper abroad?

Words like customs, NOVA and taxes put most people off importing cars.

We want to take away your fear of buying abroad with this guide. Here we give you all the information you need to know to import your used car to Austria (with examples).

- 1. Procedure for Car Import from an EU Country

- 2. NOVA Calculation for Car Import

- The deduction item

- NOVA for cars with first registration in EU 1991 until 01.03.2014

- NOVA for cars with first registration in the EU 01.03.2014 to 31.12.2019

- NOVA for cars with first registration in the EU 01.01.2020 to 31.12.2020

- NOVA for cars with first registration in the EU 01.01.2021 to 30.06.2021

- NOVA for cars with first registration in the EU 01.07.2021 to 31.12.2021

- NOVA for cars with first registration from 2022 to 2025

- The Eurotax value

- NOVA calculator

- 3. Procedure for Car imports from Third Countries

- Example: Car Import from EU Country

- Example: Car Import from Third Countries

- More Articles

1. Procedure for Car Import from an EU Country

Vehicle documents required from the seller abroad

When buying a car in another EU country, make sure that the following documents are available for the vehicle: (example German car)

Difference between private purchase & dealer purchase

When importing a car to Austria, it is essential to distinguish between a private purchase and a dealership purchase when considering car import to Austria.

In the case of a private purchase, the seller might no longer have the COC paper. In this situation, you or the seller will need to request a new one from the vehicle manufacturer. A COC paper is a confirmation that the car met European standards at the time of its first registration. This document is required for re-registration and importing the vehicle into another EU country. The cost for a COC paper is approximately €80-180.

Another disadvantage of a private purchase is that the basis for calculating the NOVA tax is higher than the actual purchase price of the car. For example, if you buy a vehicle for €5,000 from a private seller abroad, the tax office may not consider the car to be worth €5,000. Instead, they use the Austrian market value → Eurotax, which is often higher than the actual purchase price. This means you will pay a higher standard consumption tax (NOVA).

Example

Let’s assume the NOVA percentage is 6%. There is a significant difference between paying 6% of €5,000 (purchase price) and 6% of €6,500 (determined market value) to the tax office.

We therefore recommend that you limit your car search to dealerships.

When purchasing from a dealership, the tax office uses the net price of the vehicle as the basis.

Example:

A used car at a dealership in Germany costs €6,000. At the time of purchase, the VAT for used cars in Germany is 19%.

€6,000 gross - 19% = €4,860 net. Currently, the VAT is 16%, but for this example, we calculate with 19%.

The NOVA for self-import is calculated based on €4,860 and not €6,000.

Additionally, it is more likely that the dealership can provide all necessary documents (including the COC paper) for the car, unlike a private seller.

Entry in the approval database (TÜV)

Once you have received the car's documents, the next step is to schedule an appointment with the TÜV.

You must register the vehicle with its foreign EU documents in the Austrian approval database. The fee for registration and the issuance of an Austrian type certificate is approximately €120-150, depending on the federal state.

Standard consumption tax NOVA

The standard consumption tax (NOVA) is an environmentally guided surcharge imposed by the tax office on the purchase price of the vehicle. This tax must be paid when importing a vehicle to Austria or purchasing a new car in Austria.

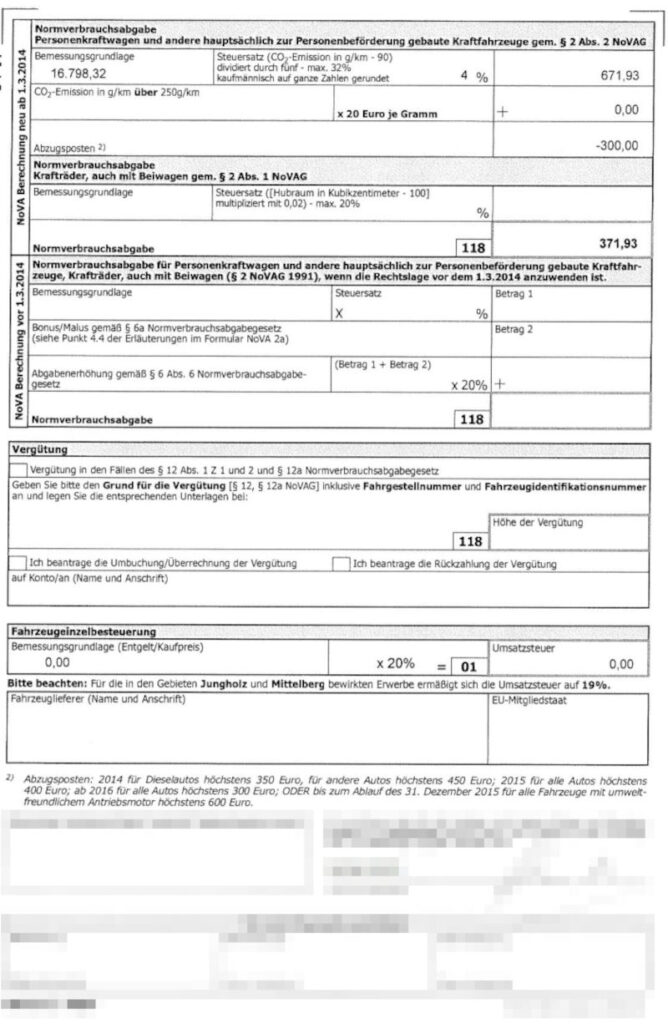

For this purpose, there is the NOVA2 form available on the ministry's website, which you need to fill out and submit to the tax office. Further down in the article, we show you how to calculate the standard consumption tax in advance to avoid any surprises.

You must pay the NOVA for the following vehicles NOT settle:

When it comes to classic cars, there are several aspects you need to consider during the import process. Not every 30-year-old car is automatically a classic car. For more details and to learn how to import a classic car to Austria, check out our article: Classic Car Import Austria.

Registration & collection

A tip: Ask your seller if they can send you the car's documents (after receiving payment). This allows you to register the vehicle and pick it up with your own license plates.

To register the vehicle, you must first complete the entry into the approval database and pay the NOVA.

This is also possible without having picked up the car yet. In most cases, the car's documents are sufficient.

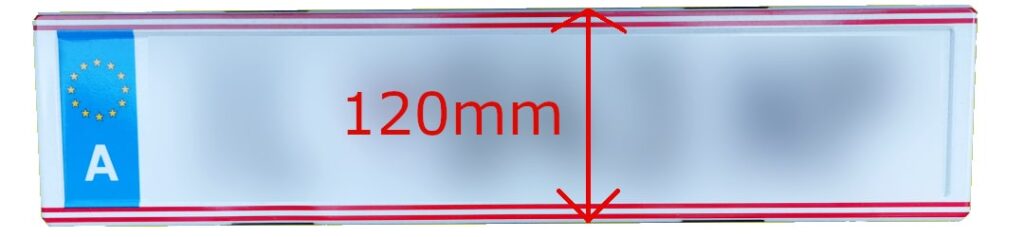

This means that Austrian license plates do not fit into the license plate holders of, for example, German vehicles.

We recommend purchasing a license plate holder for Austrian plates before picking up your car.

This is a great opportunity to say goodbye to those ugly black frames. We recommend switching to clip-on modules. Their advantages include:

- ✅ Clean look ➤ The Plexiclick combines the visual advantages of Velcro license plate holders...

- ✅ Interchangeable license plate function ➤ The mounting and dismounting of license plates is...

- ✅ Made in Germany 🇩🇪 ➤ Minimal appearance, maximum quality: the Plexiclick is made of...

- ✅ SCOPE OF DELIVERY ➤ One set contains 4x Plexiclick license plate holders, 8x drilling screws, 4x...

If you like the frame, we recommend purchasing a stainless steel frame in your desired color. It costs only slightly more than a plastic holder and adds a stylish little detail to your new car.

- -Size 520 x 120mm Only suitable for Austria, Denmark, Slovenia, Hungary

- -100 % polished stainless steel, very durable and easy to maintain

- -Also suitable for curved bumpers, no drilling required in the license plate!

- -Incl. 8 stainless steel fixing screws, rear side with 3 rubber lips

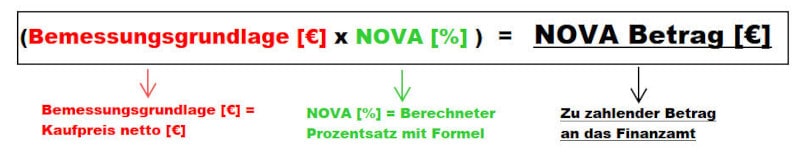

2. NOVA Calculation for Car Import

The NOVA has changed significantly over the years. It is important to know which legal framework applies to your purchased vehicle. To determine this, check the year of manufacture of the vehicle (or the first registration).

The deduction item

The deduction (that you subtract from the final calculated NOVA) was between €300 and €400 for diesel and gasoline vehicles. All of this is history, and from 01.07.2021, the following deductions apply: (as of December 2021)

The younger the vehicle, the higher the credit you receive:

NOVA for cars first registered in the EU 1991 until 01.03.2014

Formula for calculating the amount to be paid (NOVA amount) to the tax office

Assessment basis = Net purchase price from dealer or Eurotax for private purchase (see example in Difference between private and dealer purchase)

If your vehicle exceeds a certain CO2 limit starting from the year of manufacture 2008, CO2 bonus-malus payments apply. For example: For a 2018 car with over 180g/km CO2 emissions, you have to pay €25 for every gram above the 180g limit. In the following table, you can find out which category you fall into.

CO2 malus according to year of construction:

| First registration in EU | g/km (grams per kilometer) | €/g (Euro per gram) |

|---|---|---|

| 07/2008 – 12/2009 | >180 | 25€ |

| 01/2010 – 02/2011 | >160 | 25€ |

| 03/2011 – 12/2012 | >160 >180 >220 | 25€ 50€ 75€ |

| 01/2013 – 02/2014 | >150 >170 >210 | 25€ 50€ 75€ |

This table applies only to new vehicles. For used cars, you need to perform a simple ratio calculation.

Take the price of your used car and compare it to the new price of the vehicle.

The percentage (by which your used car is cheaper) is then subtracted from the values in the "€/g" column.

Example for used cars

Used car price = 20.000€

New car price = 40.000€

Your used car is 50% cheaper. You deduct this 50% from the malus amount. This means that for your 2010 car you only pay 50% of 25€ for every gram over 160g/km Co2. So 12,50€

NOVA for cars with first registration in the EU 01.03.2014 to 31.12.2019

For cars from the year of manufacture 03/2014 to 12/2019, the calculation is much easier.

![NOVA formula 2014-2019: (CO2 emissions [g/km] - 90) divided by 5 = NOVA percentage (max.32%)](http://diy-leonmotors.de/wp-content/uploads/2022/02/Formel-NOVA-fuer-Erstzulassung-EU-2014-bis-2019.jpg)

Formula for calculating the amount to be paid (NOVA amount) to the tax office (with deduction items)

The deduction can be found in the list above. The younger the car, the higher the credit.

CO2 Bonus-Malus

For all vehicles that emit more than 250g/km of CO2, you pay an extra €20 for every gram over 250g.

NOVA for cars with first registration in the EU 01.01.2020 to 31.12.2020

For cars from the year of manufacture 2020, you use the same formula as for cars from 2014 to 2019. The numbers are different, and the CO2 emissions are measured according to the WLTP procedure.

![NOVA formula 2020: (CO2 emissions [g/km] - 115) divided by 5 = NOVA percentage (max. 32%)](https://diy-leonmotors.de/wp-content/uploads/2022/02/Formel-NOVA-fuer-Erstzulassung-EU-2020.jpg)

Formula for calculating the amount to be paid (NOVA amount) to the tax office (with deduction items)

The deduction can be found in the list above. The younger the car, the higher the credit.

CO2 Bonus-Malus

For all vehicles that emit more than 275g/km of CO2, you pay exactly €40 for every gram over 275g.

NOVA for cars with first registration in the EU 01.01.2021 to 30.06.2021

For cars from the year of manufacture 2021 (until June), you use the same formula as before. Additionally, vehicles in the N1 category (goods vehicles up to 3.5-12 tons) are now also taxed with the NOVA.

![NOVA formula 01-06.2021: (CO2 emissions [g/km] - 112) divided by 5 = NOVA percentage (max. 32%)](https://diy-leonmotors.de/wp-content/uploads/2022/02/Formel-NOVA-fuer-Erstzulassung-EU-1.2021-bis-6.2021.jpg)

Formula for calculating the amount to be paid (NOVA amount) to the tax office (with deduction items)

The deduction item can be found in the chapter "Deduction items"

CO2 Bonus-Malus

For all vehicles that emit more than 275g/km of CO2, you pay an extra €40 for every gram over 200g.

NOVA for cars with first registration in the EU 01.07.2021 to 31.12.2021

For cars from the year of manufacture 2021 (from July onwards), the formula essentially remains the same. Only the maximum possible percentage has been increased and the bonus-malus threshold has been lowered.

![NOVA formula 07-12.2021: (CO2 emissions [g/km] - 112) divided by 5 = NOVA percentage (max. 50%)](https://diy-leonmotors.de/wp-content/uploads/2022/02/Formel-NOVA-fuer-Erstzulassung-EU-7.2021-bis-12.2021.jpg)

Formula for calculating the amount to be paid (NOVA amount) to the tax office (with deduction items)

The deduction item is taken from the list "Deduction items"

CO2 Bonus-Malus

For all vehicles that emit more than 200g/km of CO2, you pay an additional €50 for every gram over 200g.

NOVA for cars with first registration from 2022 to 2025

For future years of manufacture (2022-2025), the calculation formula was established in 2021. It essentially remains the same. The values are adjusted each year so that the NOVA becomes more and more expensive. This is part of Austria's strategy to accelerate its transition to CO2-neutral mobility. However, much can still change by 2025 (as usual).

![NOVA formula 2022: (CO2 emissions [g/km] - 107) divided by 5 = NOVA percentage (max. 60%);NOVA formula 2023:(CO2 emissions [g/km] - 102) divided by 5 = NOVA percentage (max. 70%)NOVA formula 2024:(CO2 emissions [g/km] - 97) divided by 5 = NOVA percentage (max. 80%)NOVA formula 2025:(CO2 emissions [g/km] - 94) divided by 5 = NOVA percentage (max. 80%)+ bonus malus invoices](https://diy-leonmotors.de/wp-content/uploads/2022/02/Formel-NOVA-fuer-Erstzulassung-EU-2022-bis-2025.jpg)

Formula for calculating the amount to be paid (NOVA amount) to the tax office (with deduction items)

The deduction item is taken from the list above "Deduction items"

The Eurotax value

For a private purchase, the Eurotax value is relevant and not the purchase price itself. Eurotax represents the actual value of the car, regardless of how much you paid for your vehicle in a private sale. Special experts and appraisers estimate this value. Eurotax is used as the assessment basis for the NOVA in a private purchase. In a dealer purchase, the Eurotax value is not relevant.

To calculate the standard consumption tax as accurately as possible without an appraiser in a private purchase, the website wirkaufendeinauto.com is a good option. This site estimates the value of your car based on the market.

We recommend adding a 5-10% safety buffer to the value provided by wirkaufendeinauto. Although this is not the final Eurotax value, it is a very good estimate. Another alternative would be the AutoScout24 valuation tool, which is based on numbers from its own vehicle marketplace.

NOVA calculator

If you find manual calculation too time-consuming, we recommend the novarechner.at. There are many calculators on the web, but we believe this one is the most reasonable and up-to-date.

This calculator takes into account the legal situation that applied at the time of manufacture and provides reliable and accurate results. However, we still recommend manually double-checking the result to be on the safe side.

3. Procedure for Car imports from Third Countries

Imports from third countries are associated with more effort and costs. It is worth calculating all the costs in advance. Afterward, check if purchasing outside the EU is still worthwhile.

In most cases, it is not.

Vehicle documents required from the seller (third country)

Customs & import tax

In addition to the NOVA, customs duties & import fees apply for imports from third countries.

The customs duty is 10% of the vehicle's purchase price. This includes all costs incurred for delivery to the EU's external border.

The import tax is 20% of the vehicle's purchase price. Here, you must add the customs duty (10%) to the delivery costs as well.

This means that if the vehicle is worth 5400€ including delivery, the customs duty is approximately 540€.

The import tax will then be (5400€ + 540€) x 20% = approximately 1188€.

That would be 1188€ + 540€ = 1728€ in total that you will have to pay just for the import. This does not include NOVA, registration in the approval database, or vehicle registration.

Have the export declaration confirmed at the third-country border. With this, you may be able to get the VAT refunded (with the cooperation of the dealer). However, you will not have any further savings potential.

As you can see, importing a car from third countries comes with high costs that, in most cases, are not worth it.

NOVA for cars from third countries

The calculation is the same as for imports from an EU country.

The only difference is that you want to register the vehicle from a third country for the first time in the EU. This means that the legal situation depends on the import date, not the vehicle's manufacturing year.

As the basis for calculation, you use the Eurotax value, unless you had the vehicle's value certified when purchasing it in the third country. If that's the case, the purchase price will be used as the basis of assessment.

Example: Car Import from EU Country

Max from Salzburg found a used BMW F30 320xd at a dealership in Munich. He decided to purchase the car for €19,990 and import it to Austria. After the purchase, he asks the dealer to send all the vehicle documents by mail. This way, Max would save himself the trip back to Germany. The dealer agrees and sends all the documents by mail. In the meantime, Max has scheduled an appointment with the TÜV for registration in the approval database.

In the meantime, he calculates the NOVA:

His car has 112g/km CO2 emissions and was built in 2015.

This means that the BMW falls into the legal situation from 2014 to 2019. The VAT in Germany is 19% for used cars (now only 16%, but we still expect the 19%).

The assessment basis for NOVA is €19,900 gross / 1.19 = €16,798 net

(112g/km - 90) / 5 = 4.4 %. The tax office rounds this value.

The NOVA therefore accounts for 4% of the assessment basis.

16,798€ x 4% = 671.93 €.

In this case, a deduction item (as of December 2021) applies to this car year of construction

(age 6 years) of -100€.

Bonus malus payments do not apply in this case as the car has less than 250g/km CO2 emissions.

The standard consumption tax thus amounts to €571.93.

In the meantime, the TÜV has completed the entry in the approval database and Max has an Austrian type certificate. Now he pays the standard consumption tax at the tax office (form NOVA2) and he can register the BMW.

Since Max wants to save on transfer license plates, he registers the car and picks it up with its license plates. Of course, he has also packed an Austrian license plate holder.

Total costs for car import in this example:

| Purchase price car | 19.900€ |

| Entry Approval database (TÜV) | approx. 130€ |

| NOVA [%] | 572€ |

| Admission & registration | approx. 180€ |

| Fuel | 70€ |

| Sum: | 20.942€ |

Table total costs for own import from EU country (example)

Example: Car Import from Third Countries

Max purchased a 2015 VW Passat B7 for €15,000 net in a third country. He wants to import the car to Austria. He receives the T1 form at the EU external border and completes the import declaration online.

He has the export declaration confirmed at the third-country border and gets the VAT refunded by the dealer.

Transportation to Austria costs around €600.

At the Austrian border, he pays the customs duty (10% of the value) and obtains a customs confirmation.

The customs fee is €1,560

At the TÜV appointment, he presents the car and has it entered in the approval database. The costs for the COC paper are also added.

For the registration and the COC paper there are expenses of approx. 230€

The next step is to pay the import tax and NOVA.

The import tax is 20% of the value of the car with the delivery costs and the customs amount.

15.000€ + 600€+ 1.560€ = 17.160€

17160€ x 20% = 3432€ import tax.

Max was unable to have the price of the car certified. As a result, the basis of assessment is the Eurotax value, which for this example is €17,500.

Max imports the car in 2021, so the vehicle will be registered in the EU for the first time in 2021 and will be taxed according to the legal situation in 2021.

That means:

CO2 emissions according to WLTP are 179g/km

(179g/km-112)/5 = 13% NOVA

17,500€ x 13% = 2,275€ - 100€ deduction for 6 year old vehicles = 2,175€

Max can now register the vehicle.

Total costs for car import in this example:

| Purchase price car | 15.000€ |

| Delivery | approx. 600€ |

| Customs | 1560€ |

| Import fee | 3.432€ |

| Registration + COC paper | 230€ |

| NOVA [%] | 2.175€ |

| Admission & registration | ca.180€ |

| Sum: | 23.177€ |

Table of total costs for own imports from third countries (example)

* Affiliate links are marked with a *. Nothing changes for you and the offer/price remains the same. You can find more information about affiliate links here.

More Articles

BMW Android Auto & Carplay retrofit | Plug & Play | CARLUEX

BMW Android Auto & Carplay retrofitCARLUEX Experience Are you driving a BMW built before 2020 and want to finally use Android Auto?...

BMW Sport Plus coding: Unlocking driving mode - instructions

BMW Sport & Comfort Plus codingUnlocking driving mode - BMW coding made easy - In this guide you will learn step by step how to...

BMW coding software comparison 2025 | ESys, BimmerCode & Co

BMW Coding Software ComparisonESys, BimmerCode & Co. There are now countless tools for coding a BMW. Different software providers offer...